Table of Content

While charges vary across states, the buyer will pay 0.10%-0.20% of the loan amount as the stamp duty and registration charge. How can I compare the processing fees of different banks’ home loans? This page contains a tabular list of all the banks and their home loan processing fees. However, some financial institutions either do not charge any processing fee or waive it as a special offer. Some banks may have separate charges for salaried persons, self-employed professionals , and self-employed non-professionals .

You can avail aPersonal Loanfrom Kotak with the same documentation to meet unexpected expenses. Introducing e-vouchers from 180+ brands across a wide range of categories. Rs. 50/-plus applicable taxes and other statutory levies, if any. Also note that the bank in whose favour the cheque has been issued can file a complaint under Section 138 of the Negotiable Instruments Act over the cheque bounce.

Top 10 Fastest Growing Cities In India 2022

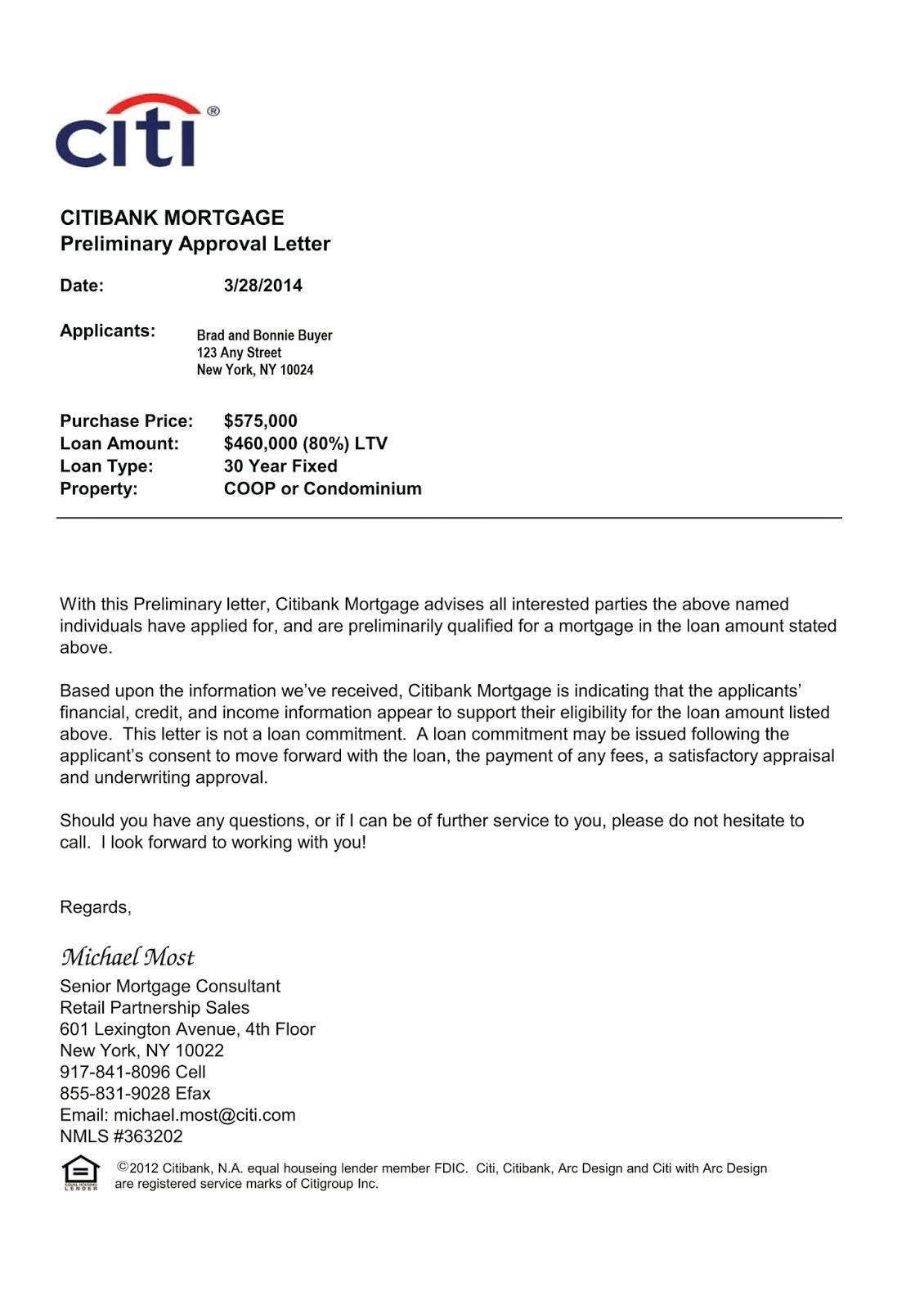

Bajaj Finserv offers competitive home loan interest rates along with low processing fees. When it comes to home loan interest rates, you should always compare and work out your monthly repayment using a housing loan EMI calculator. The home loan processing fee is the charge borne by you, the borrower, towards the lender once your home loan application has been accepted. Make sure to calculate the cost of your home loan by taking the processing fees into consideration. Compare lenders and choose a home loan with the lowest processing fee.

The property papers are generally kept as a collateral deposit with the banks till the full payment of the amount borrowed plus interest if any. Of course, you need to have a regular source of income to avail home loans. Banks assess the income level before granting loans as they need to be sure that the borrower returns the borrowed sum and also his liability to pay interest on loans. A) 2% on Home loan, Home improvement loan, Land loan and Top up on home loan on amount prepaid and on all amounts tendered by the Borrower towards prepayment of the Facility during the last one year from the date of final prepayment.

e-Rupee: All About The Digital Currency of India

Bank of Baroda grants a Home Loan for a maximum tenure of 30 years. The loan term will under no circumstances exceed the age of retirement or completion of 65 years of age, whichever is earlier. The Home Loan tenure also varies based on the loan amount and the income of the borrower.

Information about ABML/ABFL, its businesses and the details of commission structure receivable from asset management companies to ABML/ABFL, are also available on their respective Website. Upon any change, the updated Terms of Use will be updated on the Website or any other means. Your continued use of the facilities on this Website constitutes acceptance of the changes and an Agreement to be bound by Terms of Use, as amended. You can review the most current version of the Terms of Use at any time, by clicking the Terms & Conditions link on the Website.

Home Loan Processing Fee of All Banks in India

You can pay off any existing balance of Home Loan using Kotak’s Home Loan Balance Transfer at a lower rate of interest. In the absence of salary slips, especially for non-salaried individuals, applicants may submit bank statements and complete ITR details as required by the lending bank. So, although salary slips improve your chances to get a home loan, it’s not mandatory. I really appreciate Kotak Bank & the team for their efforts in helping me buy my first home. I preferred Kotak bank over other banks due to lower rate of interest and my existing relationship with Kotak Bank. Grid Connected Rooftop Solar Photovoltaicprojects across the country through its identified branches .

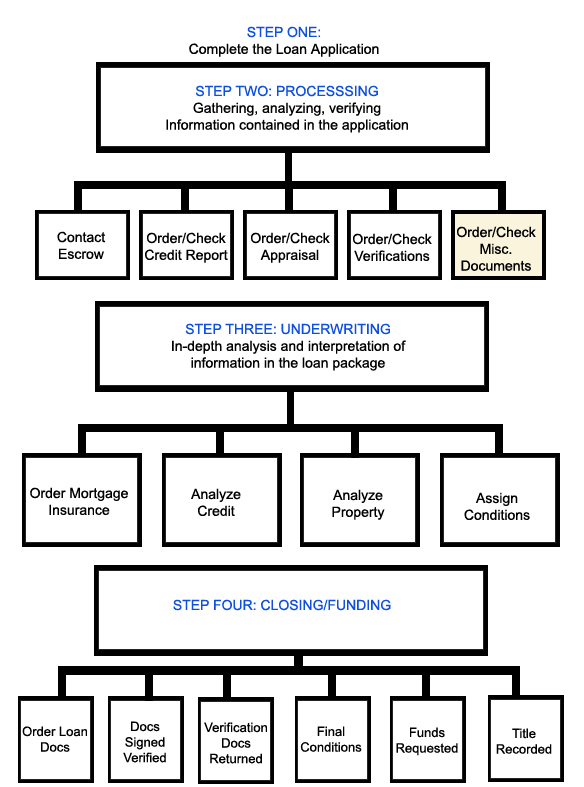

The processing fee for home loan is a percentage charged on the loan amount that you have applied for. These home loan processing fees are non-refundable, i.e. the bank will not refund the amount, whether the loan application is approved or not. The reason banks and finance companies charge processing fees is to cover the costs of collecting, maintaining and verifying documents to get the loan approved. This takes time and manpower, for which each bank charges its own fees. The bank must incur certain administrative costs while processing and sanctioning your loan. This is typically a small amount that varies by bank and typically costs between 0.5 percent and 2.50 percent of the total loan amount.

However, your loan amount does factor in calculating the processing fee. A Baroda Home Loan is charged at the prevailing floating rate which is linked to external benchmark of REPO or MCLR . The interest rate is linked to the Baroda Repo Linked Lending Rate and is reset annually based on your bureau score.

As punishment, you may have to serve a jail term or pay a penalty of double the amount, or both. AT HDFC, delayed payment of interest or EMI will render the customer liable to pay additional interest of up to 24% per annum. The realtor.com® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission. You are advised to be cautious when browsing on the internet and to use good judgment and discretion when obtaining information or transmitting information. From this Website, users may visit or be directed to third party web sites.

To ensure timely Home Loan repayments and ensure extended benefits, open aSavings Accountfrom Kotak. Similar to residential address checks, banks also run a verification of the official address to check the facts. Hence, it is important to be completely transparent and truthful about one’s whereabouts before applying for a home loan. If your mortgage is escrowed, your monthly payment will include more than just the loan payment. Prepare for closing on your new home buy reviewing all the potential closing costs you may encounter. Housing.com shall not be liable in any manner for any losses, injury or damage suffered by such person as a result of anyone applying the information in these articles or making any investment decision on the basis of such information , or otherwise.

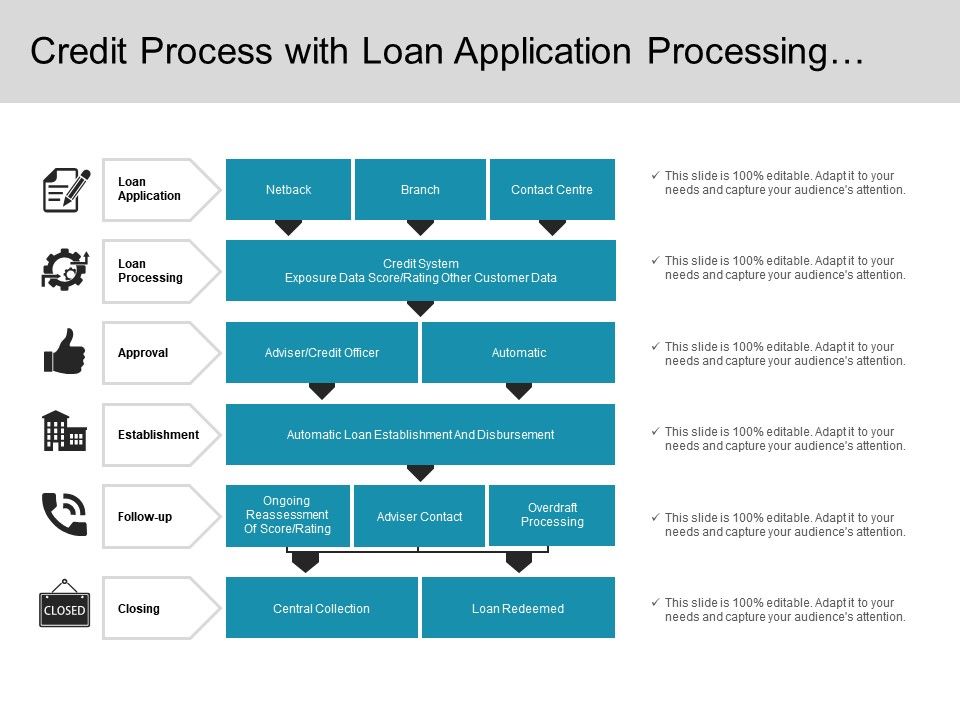

So check the applicability of the same before filling the Home Loan application. The bank has received the title deeds and ownership documents for your property as security for the loan, according to the Memorandum of Deposit on Title Deed . There are various charges applicable to legal documentation of the home loan process. Home loans include several additional fees, fines, and penalties in addition to the processing cost. While processing and approving your loan, the bank incurs some administrative charges.